The European Union Markets in Crypto Assets Regulation (MiCA)

What is it?

The European Union’s (EU) Markets in Crypto Assets Regulation(MiCA) contains rules covering crypto-assets and related services and activities that are not covered by other EU legislation. MiCA is the first multi-jurisdiction framework created specifically to regulate crypto-asset markets and when it applies, it will replace domestic regulations for the crypto-asset markets that have been developed in several EU Member States.

What are the main provisions?

MiCA contains rules covering: (i) the authorisation, supervision, operation, organisation and governance of crypto asset service providers (CASPs); and (ii) the offering and issuance of crypto-assets. MiCA’s high-level provisions are similar in many respects to other EU financial services regulation such as the markets in financial instruments regime (MiFID/R).

MiCA’s provisions cover the following:

Transparency and disclosure for the issuance, offer to the public and admission of crypto-assets to trading on a trading platform for crypto-assets;

The authorisation, supervision operation, organisation and governance of crypto-asset service providers, issuers of asset-referenced tokens and issuers of e-money tokens;

The protection of holders of crypto-assets and clients of crypto-asset service providers.

Prevention of insider dealing, unlawful disclosure of inside information and market manipulation related to crypto-assets, in order to ensure the integrity of markets in crypto-assets.

Who and what is in scope?

MiCA applies to entities and individuals: (i) engaged in the issuance, offer to the public and admission to trading of crypto-assets; and (ii) providing services related to crypto assets in the EU. MiCA covers ‘Crypto Asset Service Providers’ and Crypto-asset issuers and ‘offerors’.

Crypto-Assets

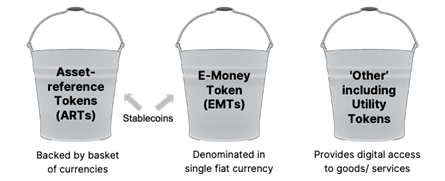

MiCA defines a crypto-asset as a ‘digital representation of a value or of a right that is able to be transferred and stored electronically using distributed ledger technology or similar technology’. MiCA’s taxonomy defines the following three types of crypto-asset based on whether the crypto-asset seeks to stabilise its value by reference to other assets or not.

MiCA does not refer to individual crypto-assets by name (e.g., bitcoin, or ETH) or to types of crypto-assets that are used in nomenclature, such as stablecoins. Instead, each crypto-asset will need to be considered under the definitions in MiCA’s taxonomy to determine how it will be classified. For instance, stablecoins meeting the definition of a crypto-assets and purporting to maintain a stable value may be considered an asset-reference token (ART) or an e-money token (EMT), depending on whether they reference one or more official currencies. Other crypto-assets that meet the definition of a crypto-asset but do not purport to maintain a stable value may fall under the ‘other’ classification. This assumes that the crypto-asset is not deemed to be a financial instrument and therefore outside the scope of MiCA (and likely subject to MiFID).

Issuers and Offerors of Crypto Assets

MiCA imposes various requirements on issuers of crypto-assets and the offering of crypto-assets to retail investors. MiCA’s provisions on the issuance and offering of crypto-assets are similar in several respects to other EU financial services regulation such as the prospectus regime.

MiCA sets out different requirements for the offering of ARTs, EMTs and ‘other’ crypto-assets. In all cases, the offeror of the crypto-asset must draw up a white paper describing various aspects of the crypto-asset. Offerors and issuers must comply with other requirements as described below, depending on the classification of the token they are offering or issuing.

Asset Reference Tokens (ARTs) – MiCA requires the offeror of most ARTs (unless they benefit from exemptions) to seek prior authorisation and comply with various requirements, including providing ongoing regulatory reports. MiCA also imposes obligations on the issuer of ARTs including concerning their conduct, the publication of a white paper, marketing communications, investor disclosure, governance, prudential requirements, reserve assets (amount, investment, custody), recovery plans and investor redemption.

E-Money Tokens (EMTs) – MiCA requires the offeror of EMTs to be authorised as a credit institution or E-Money Institution and comply with rules including concerning marketing communications, investment of funds received in exchange for the EMT, recovery plans and investor redemption.

Other Crypto-Assets – MiCA requires the offerors of other crypto-assets (i.e., that are not ARTs or EMTs) to comply with rules including concerning marketing communications, investor redemption, and conduct.

ARTs and EMTs may be classified as ‘significant’ based on various criteria including transaction volumes and value/market capitalisation and therefore subject to additional rules and supervision.

Crypto Asset Service Providers

MiCA imposes various requirements on crypto asset service providers (CASPs) which are defined as firms or other undertakings providing one or more crypto-asset services to clients in the EU on a professional basis.

MiCA defines the following as crypto-asset services:

providing custody and administration of crypto-assets on behalf of clients;

operation of a trading platform for crypto-assets;

exchange of crypto-assets for funds;

exchange of crypto-assets for other crypto-assets;

execution of orders for crypto-assets on behalf of clients;

placing of crypto-assets;

reception and transmission of orders for crypto-assets on behalf of clients;

providing advice on crypto-assets;

providing portfolio management on crypto-assets; and

providing transfer services for crypto-assets on behalf of clients.

MiCA requires CASPs to be authorised before they provide crypto-asset services, including meeting various substance requirements such as having a registered office and effective management in the EU. CASPs are also subject to various ongoing obligations covering the following aspects of their business, conduct, governance and operation:

Client ‘best interest rules – covering honest, fair and professional conduct and the provision of information;

Prudential requirements – similar to those applicable to firms under the Investment Firm Prudential Regime and consisting of a base capital and fixed overheads requirement;

Organisational requirements – covering governance and the repute and experience of senior managers;

Safekeeping rules – covering safeguarding, custody and segregation obligations;

Complaint handling – covering client information requirements, complaints procedures and recordkeeping;

Conflicts of interest rules – covering the identification, prevention, management and disclosure of conflicts of interest;

Outsourcing rules – covering minimum substance requirements and outsourcing policy rules;

Orderly wind-down planning – requiring the production of a plan for the orderly wind-down of a CASP without causing undue economic harm to clients.

CASPs are subject to additional rules where they are undertaking specific crypto-asset services, including custody and administration, operating a trading platform or running an exchange. Furthermore, if a CASP has an average daily userbase that exceeds 15 million users then it is deemed to be ‘significant’ and subject to additional obligations.

CASPs that are authorised and meet the various compliance obligations under MiCA can benefit from a ‘passport’ which enables the CASP to provide crypto-asset services on a cross-border basis across the EU, subject to a notification procedure.

How might this impact financial sector entities?

Asset managers, investment firms and other market participants are increasing their engagement with crypto-assets and therefore may engage with CASPs that will be authorised and operate under MiCA. Furthermore, MiCA enables various authorised entities including UCITS Management Companies, Alternative Investment Fund Managers and MiFID Investment Firms to extend their permissions to cover crypto asset services, subject to a notification procedure. Financial services entities who might seek to provide crypto asset services in the future should consider the obligations of the MiCA framework.

A large number of technical standards and guidelines are required by the MiCA Regulation (for example guidelines on the criteria and conditions for the qualification of crypto-assets as financial instruments. ESMA’s and the EBA’s plans for the development of these are set out on the ESMA website and EBA website.

The Central Bank of Ireland provides information on the authorisation of Irish based entities under MiCA.

What is the timeline?

MiCA was published in the EU’s Official Journal on 9 June 2023 and entered into force on 20 June 2023. Certain provisions covering the offerors and issuers of ARTs and EMTs (i.e. including stablecoins) will apply from 30 June 2024 and the remainder of the provisions will apply from 30 December 2024.